When people talk about “economic development,” it often feels like a distant concept—numbers in textbooks, models on lecture slides, or case studies about countries we’ve never visited. But for me, economic development is not just theory; it’s lived reality. As a Rwandan, I’ve seen my country change rapidly in just a few decades, and Rwanda’s story is now a fascinating case study for anyone interested in development economics.

📈From Tragedy to Transformation

In 1994, Rwanda’s economy quite literally collapsed. The genocide against the Tutsi destroyed not only lives but also institutions, infrastructure, and social trust. GDP shrank by more than half in a single year, and for many outsiders, Rwanda seemed destined for permanent poverty.

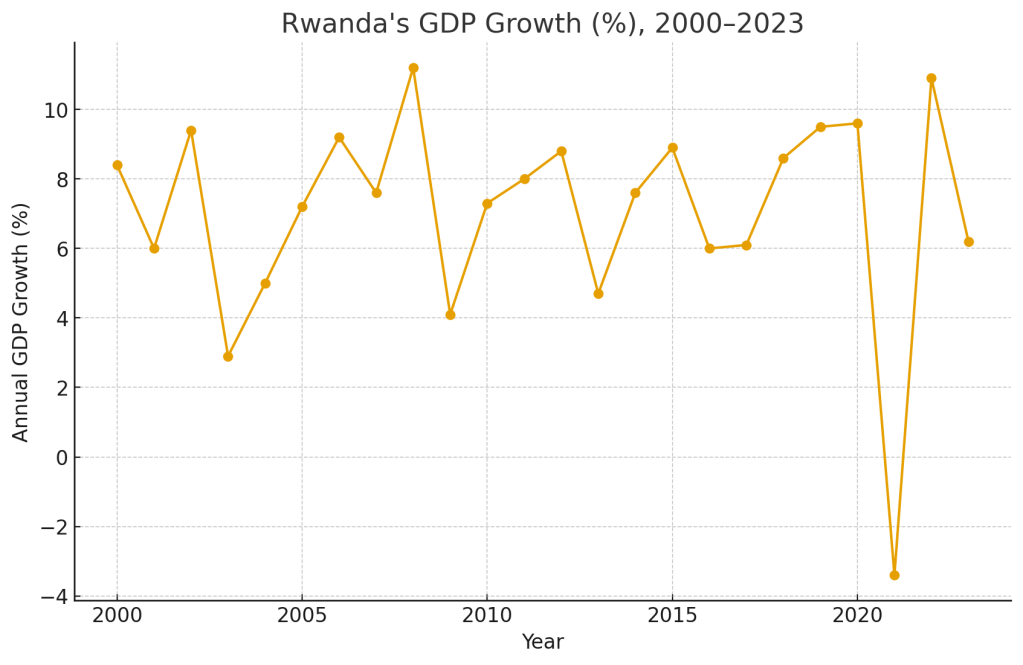

But the story didn’t end there. In the years that followed, Rwanda rebuilt itself through a combination of strong governance, forward-looking policy, and international partnerships. Since the early 2000s, Rwanda has consistently achieved growth rates of 7–8% per year, one of the fastest in Africa.

This transformation raises important questions for development economists: how can a resource-scarce, landlocked country overcome the odds? Which policy choices make the difference between stagnation and sustained growth?

🌹The Policy Foundations of Growth

Rwanda’s progress rests on several pillars:

- Good Governance and Low Corruption

Unlike many post-conflict states, Rwanda put governance at the centre of its strategy. Through strict anti-corruption measures and an emphasis on performance contracts for public officials (known as imihigo), the government created institutions that people could trust. Transparency International now ranks Rwanda among Africa’s least corrupt countries. - 🧠Human Capital Investment

Economic development is ultimately about people. Rwanda prioritised education and healthcare, extending universal primary education and implementing community-based health insurance (mutuelles de santé). These policies have helped raise literacy rates and life expectancy, creating a healthier, more skilled workforce. - Infrastructure and Technology

From roads to internet connectivity, infrastructure investment has been central. Rwanda has branded itself the “Singapore of Africa,” focusing on efficiency, digital governance, and ICT innovation. Initiatives like the Kigali Innovation City aim to attract tech companies and position Rwanda as an East African tech hub.

Engines of Economic Growth

So where is growth actually coming from?

- 🌱Agriculture remains the backbone of the economy, employing around 70% of the population. Reforms such as land consolidation and crop intensification have raised productivity, though food security remains an ongoing challenge.

- Tourism and Services have expanded rapidly. Rwanda has become a high-end eco-tourism destination, with gorilla trekking in Volcanoes National Park as its flagship attraction. Kigali has also positioned itself as a regional hub for conferences and international meetings.

- 🤖Finance and Innovation are growing areas. Mobile money has transformed everyday transactions, while fintech start-ups are beginning to attract investment. Rwanda is part of the African Continental Free Trade Area (AfCFTA), which may open new opportunities for trade and services.

⛅Challenges on the Horizon

Of course, rapid growth does not mean Rwanda’s development story is complete. Some key challenges remain:

- Poverty and Inequality: Despite growth, many Rwandans remain in subsistence farming, and bridging the rural-urban divide is essential for inclusive development.

- 🩹Dependence on Aid: Foreign aid still plays a significant role in financing public investment, raising questions about long-term sustainability.

- 🏛️Small Domestic Market: With just over 13 million people, Rwanda’s market is limited, so integration with regional and global markets is vital.

- Climate Vulnerability: As an agrarian economy, Rwanda is especially exposed to climate shocks, making sustainability a pressing issue.

Why Rwanda is a Case Study Worth Watching

For students of economics and development, Rwanda is a fascinating laboratory. It demonstrates how institutions and governance—not just natural resources or geography—can shape economic outcomes. It also challenges traditional development narratives, showing that a country with limited physical endowments can still achieve rapid growth through smart policy.

And for me personally, Rwanda’s story is not just data or policy analysis—it’s home. Every new road I’ve seen built, every young entrepreneur I’ve met in Kigali’s growing startup scene, and every success story from rural farmers reminds me that economic development is ultimately about improving people’s lives.

⚘Looking Forward

The next stage of Rwanda’s economic journey will depend on moving from growth to transformation: building a knowledge-based economy, reducing inequality, and ensuring that development is environmentally sustainable. If successful, Rwanda could become a model for other small, resource-scarce nations facing similar challenges.

For students like me, Rwanda’s story isn’t just inspiring—it’s an invitation. An invitation to study how economics can be applied in practice, how development can be shaped by policy choices, and how a nation’s trajectory can be changed by determination and vision.

Leave a comment